In 2021, Illinois increased the minimum wage, as well as penalties for violations of wage and hour laws, but tipped workers remain particularly vulnerable to wage theft and exploitation. Know your rights and protect yourself.

1. Know the Current Minimum Wage

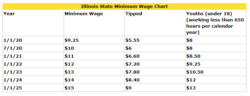

Illinois’ minimum wage is set to incrementally rise to $15 by 2025. You need to make sure that your employer is paying you the correct current minimum wage.

As of January 2021, the minimum wage in Illinois is $11.00/hour. Some states require employers to pay their tipped workers the full minimum wage. In these “one fair wage” states, tipped workers get to take home the minimum wage and all of their tips. Illinois, however, is not a “one fair wage” state. Tipped workers have a lower minimum wage of $6.60/hour.

Tipped workers may be paid 60% of the hourly minimum wage by law. The rationale is that, while all workers must earn the minimum wage, employers get to count some of the tips you earn to go towards reaching that minimum wage. This is called a “tip credit.”

The minimum wage is set to increase as follows:

IL Minimum Wage Chart

2. Understanding the “Tip Credit”

I spent many years working for tips at restaurants and bars as a delivery driver, deep fryer, and bar back before entering the legal field. One of the most shocking things I witnessed was when I asked one of my co-workers at a now closed bar how much her paycheck was on pay day. She told me that although she worked over 40 hours a week, she never received paychecks because her tips, as calculated by the employer, exceeded the minimum wage. She took home $0 in wages from the boss. This is a perfect example of illegal wage theft. While some employers do not understand the “tip credit,” many employers count on you not understanding the “tip credit” in order to get free labor and steal your hard earned pay.

Even though the tipped minimum wage is lower, all workers must make the full $11 minimum wage. In Illinois, employers may pay tipped workers 60% of the minimum wage (see above), as long as workers earn enough in tips to reach the full minimum wage of $11. This is called a “tip credit.” This is why $6.60/hour is the absolute least the employer can pay tipped employees per hour. If an employee doesn’t make enough in tips during a given workweek to earn at least $11 per hour, the employer has to pay the difference.

The tip credit does not mean that your boss does not need to pay you anything if you earned $11 per hour in tips during your shift. The absolute minimum your employer must pay you in wages is that 60% of the minimum wage ($6.60/hour) regardless of how much you make in tips that shift. The employer’s tip credit can not exceed 40% of the minimum wage.

3. Receiving Overtime Wages

In Illinois, employees are entitled to overtime if they work more than 40 hours in a workweek. Tipped workers routinely work in excess of 40 hours per week and are pressured to pick up shifts to cover for their co-workers. Most people are fine with picking up extra shifts, but you need to make sure you are paid what you are owed.

Overtime pay is time-and-a-half. This means that you are owed an extra 50% of your hourly rate, on top of your regular pay. So if you are usually paid $11 an hour, you must be paid $16.50 each hour over 40. Failing to pay overtime is one of the most common wage violations by employers. They count on you and your co-workers to not know the law and not ask for what you are owed.

4. How to Get Accountability

- Civil Lawsuits

If you are the victim of wage theft, we can help you bring a lawsuit against an employer in civil court.

The time limits for cases filed in state and federal court depend on your claim and the situation. Minimum wage and overtime claims brought under state law must generally be filed within three years. Under federal law, you have two years to file claims for overtime or minimum wage violations. , Do not wait to contact an attorney until your time limit is close to expiring, as you might have other legal claims with shorter deadlines

The Illinois Wage Payment and Collection Act protects workers who do not receive their fair wages. The damages for these claims are designed to be high, so that the costs of bringing the lawsuit do not exceed the amount of stolen wages. In May 2021, the Illinois legislature passed an amendment that further increased the penalties under the law. You can recover not only your unpaid wages, but also a 5% penalty for each month following the date of payment during which the amount owed remain unpaid. On top of that, your employer may be responsible for your litigation expenses, court costs, and attorneys’ fees.

In the past, managers or individual owners could avoid wage claims because the “employer” was technically a corporation. Under the Illinois Wage Payment and Collection Act, you can now recover from the employer and any officer or agent like a manager or individual owner. Officers or agents will personally be on the hook for an employee’s unpaid wages and any fees or penalties if they knowingly permit the employer to violate the Act.

Most importantly, your boss cannot fire or retaliate against you for filing a claim. If they do, they are subject to additional civil claims, penalties, and even criminal action.

- Class Actions

Your boss may think they can ignore wage and hour laws when just one worker alone is complaining, but they will have to pay attention when all their workers speak out together. We can help you and your co-workers bring a wage and hour lawsuit under the state Illinois Wage Payment and Collection Act and federal Fair Labor Standards Act (FLSA). These laws permit you to file a collective action on behalf of yourself and your current and past co-workers.

Section 16(b) of the FLSA authorizes employees to act together for violations of the FLSA. When the FLSA case is filed and certified, other similarly situated workers then receive a notice to opt-in and join the collective action. Under Federal Rule of Civil Procedure 23(b)(3), we can also ask the court to recognize a class action under state law like the Illinois Minimum Wage Law and the Illinois Wage Payment and Collection Act. Under state law class actions, similarly situated workers are automatically included and receive a notice to opt-out if they choose. These are powerful tools to correct past wrongs and prevent future abuse.

- Illinois Department of Labor

Alternatively, we can help you file a claim with the Illinois Department of Labor. You have one year from when you last worked for your employer, or one year from when the unpaid wages are owed, whichever is later, to file your claim. If you do not file your claim in time, it will be automatically thrown out. This is called the statute of limitations.

The labor department will inform the employer of the claim. At that time, the employer could agree to pay the claim or dispute the claim. The department of labor will schedule a hearing where you present your evidence and your boss will present theirs. Both parties will have an opportunity to appeal the department’s decision.

5. What You Should Do

If you are concerned that you are, or have been, the victim of wage theft there are a few steps you should take:

- Keep track of your tips, hours and your paid wages. Write down your tips at the end of each shift and save your pay stubs. Write down your hours for each week.

- Talk to your co-workers. See if your other co-workers are experiencing similar problems with receiving their fair pay.

- If you have questions, or think you may have been the victim of wage theft, give us a call (312.443.1488) and we will provide you with a free consultation.

Disclaimer: The information contained in this article is for general educational information only. This information does not constitute legal advice, is not intended to constitute legal advice, nor should it be relied upon as legal advice for your specific factual pattern or situation.